If you’ve ever tried to compete for the latest pair of Adidas designed by Kanye, or lusted after a Birkin bag that you’ll never be able to afford, then you are already familiar with the concept of artificial scarcity. Brands market high end goods as limited editions in order to drive up the price and the demand. It creates exclusivity and buzz around a product.

How, then, does this same marketing ploy weave its way through the world of information buying and selling? Isn’t online content as easy as a ‘click’ to access and share? How can a limit be placed on something that isn’t actually tangible? Leave it to the experts – the folks at Harvard Business Review (HBR) have managed to do exactly that.

Ryerson subscribes to HBR both in print and electronically via the EBSCO database, Business Source Elite. EBSCO has exclusive distribution rights for HBR. The HBR 500, as it’s come to be known in the information world, is a collection of the 500 most read HBR articles (as determined by HBR). In 2013, HBR made these articles “read only”, meaning they could no longer be used as course readings unless the library agreed to pay an outrageously priced supplemental fee, on top of existing subscription fees. This fee ranged from $10,000 to as high as $200,000. We chose not to pay. Sure, you can still find those articles via Business Source Elite, but you can’t link to them, download or print them.

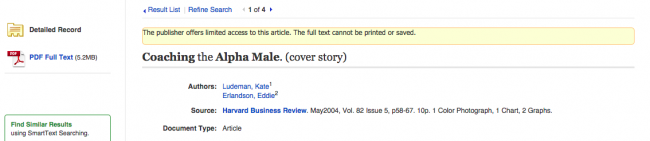

Here’s a screenshot of what this actually looks like – a subtle barrier to access, but a barrier nevertheless:

Exclusivity when it comes to scholarly publications is bad for libraries and bad for students. It hinders access when we should be moving toward open access. It drives up prices for artificial reasons and creates further strain on library and university budgets. What works well in the commercial world is not necessarily contributing to the greater good. Altruistic though it may sound, librarians are on guard to monitor these tactics, lest they set precedents for the rest of the publishing sector.

Further reading:

Narayandas, Das. “Harvard Business Review Answers its Critics.” Financial Times. October 17, 2013.